150 Motor Pkwy Suite 401, Hauppauge, NY, 11788

Pricing not available

Caring.com offers a free service to help families find senior care and authentic reviews to help you in...

150 Motor Pkwy Suite 401, Hauppauge, NY, 11788

Pricing not available

80 Orville Dr, Suite 100 , Bohemia, NY, 11716

Pricing not available

700 Veterans Memorial Highway, Suite 207 , Hauppauge, NY, 11788

Pricing not available

Caring's Family Advisors are here to help you with questions about senior living and care options.

Genworth’s Cost of Care Survey averages the monthly cost for home care in Hauppauge at $4,767. Home care services in the town cost slightly less than the state median of $4,814 and are $283 above the national average.

Hauppauge is more affordable for home care than the metropolitan New York City and the city of Poughkeepsie, where the average cost is $4,957 per month. The area is also more cost-effective than other cities near the eastern state line such as Albany ($5,148) and Glenn Falls ($4,910). However, in the Kingston area, the average rate of $4,385 for home care is below Hauppauge.

Hauppauge

$4,767

New York State

$4,814

United States

$4,481

New York City

$4,957

Poughkeepsie

$4,957

Kingston

$4,385

Albany

$5,148

Glens Falls

$4,910

Home care in Hauppauge costs $381 less than home health care. However, the latter is more suitable for seniors who also require some nursing services such as diabetes management. The least costly form of senior care in the area is adult day health at a median rate of $1,926. Residential care units such as assisted living facilities and nursing homes are the most expensive forms of senior care and they cost $7,838 and $14,113, respectively.

Home Care

$4,767

Home Health Care

$5,148

Adult Day Health

$1,926

Assisted Living

$7,838

Nursing Home Care (semi-private room)

$14,113

Note: Data for Hauppauge was unavailable, so data for the nearest city, Bridgeport, Connecticut, was used instead.

Given the high cost of in-home care, many people use one or more forms of financial assistance to cover the expenses. Below, we explain some of the most common sources of financial help for paying for in-home care. If none of these options are available to you, you can reach out to your Area Agency on Aging or Aging and Disability Resource Center to learn about local resources.

Long-Term Care Insurance: Long-Term Care Insurance covers expenses related to senior care, including in-home care. Depending on the policy type, beneficiaries may receive a cash payment to use towards long-term care or reimbursement for qualifying long-term care expenses. Note that there are limitations- typically a maximum benefit of $150 per day- and exact coverage terms vary depending on the exact policy, so always check the details.

Medicare: Medicare does not cover in-home care because it is classified as custodial, or non-medical, care. However, some Medicare Advantage and Medicare Supplement plans, which offer expanded benefits, may cover in-home custodial care.

Medicaid: Medicaid coverage of in-home care varies between different states because it is not a federally mandated benefit. Currently, all states cover some in-home care either through their standard Medicaid or a waiver program. The specific coverage rules are set individually by each state.

Veterans’ Benefits: The Aid and Attendance benefit is a monthly cash payment that beneficiaries can use to pay for senior care, including in-home care services. To qualify for A&A, Veterans must already receive the VA pension and meet several additional requirements, including needing assistance with the activities of daily living.Contact the Department of Veterans Affairs to learn more.

Reverse Mortgages: Home Equity Conversion Mortgages (HECMs) are federally insured loans that are available to homeowners age 62 and over. Reverse mortgages allow you to access a portion of your home’s equity in cash, tax free. Many seniors use reverse mortgages to finance their care expenses, including in-home care. Note that although there are no monthly payments due on reverse mortgage loans, borrowers do have to repay the loan once the last surviving homeowner passes away, moves, or sells the home.

Seniors in Hauppauge have access to a range of programs created to help them continue to safely age in place. Resources can help with essentials such as meal delivery, home improvements and financial assistance.

| Resource | Contact | Service |

|---|---|---|

| Suffolk County Office for the Aging In-Home Care | (631) 853-8200 | The Suffolk County Office for the Aging has two home care programs that can help low-income seniors receive the assistance they need. Older adults can apply for a care manager to provide an individual assessment of their needs and check eligibility. |

| The Home Energy Assistance Program | (631) 853-8825 | HEAP is a financial benefit that can help seniors with the cost of heating during the cold season. This program is state-funded and the amount of benefit available is determined based on income. Homes with seniors aged 60 and older are prioritized on the waiting list. |

| Weatherization Assistance Program | (631) 471-1215 ext. 155 | WAP is a free service for Long Island seniors overseen by the New York State Homes and Community. Eligible older adults can receive home improvement works that can help reduce energy costs. |

| Touro Law Center Senior Citizens Law Program | (631) 761-7470 | Older adults aged 60 and older in Suffolk county can contact the Touro Law Center for free legal advice on a range of civil topics. Lawyers with the services can help seniors on issues such as health insurance, public benefits, home improvement benefits and guardianship. |

| Suffolk County Office for the Aging Nutrition Programs | (631) 853-8227 | The county manages a few meal delivery programs for older residents. Following an assessment, home-delivered meals are free of charge for eligible seniors. This service is meant to help older adults continue living at home while receiving the nutrition they need. |

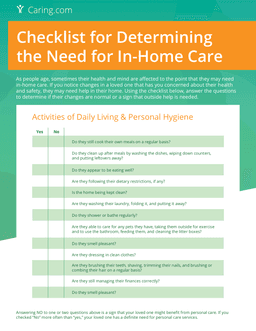

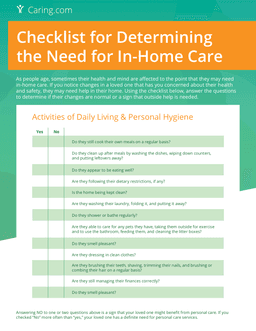

Aging can be a difficult process, and loved ones may not always ask for help – oftentimes it’s up to their family to evaluate their need for help around the house. While no two situations are exactly alike, this checklist can help you and your loved ones determine when it’s time to start the search for a home care provider.

If you’ve determined that your loved one needs the assistance of a care provider in their home, it may be time for a difficult conversation. Handled correctly, however, this process can bring a family together and ensure that everyone’s concerns are addressed. Use this PDF as a starting point to help the conversation stay as positive and productive as possible.

Home Care

RGNYC

5.0

Review of Right At Home Smithtown

Right at Home provided round-the-clock home health aides during my father’s home hospice. All of the aides and office staff (in particular aides Nadine, Michelda, Caurine and Ruth and Vicky and...

Home Care

nrjyzrbunny

5.0

Review of Right At Home Smithtown

Right At Home is attentive to your individual needs. They go above and beyond to ensure professional care. Communication is key and they are on top of their game in all regards. The caretaker...

Home Care

Patricia

5.0

Review of Right At Home Smithtown

This agency provides a “caregiver” (Liz) for my spouse, for 16 hrs/week. Liz is very personable, positive, and responsible…she takes my spouse for walks, reviews worksheets with him and assists...